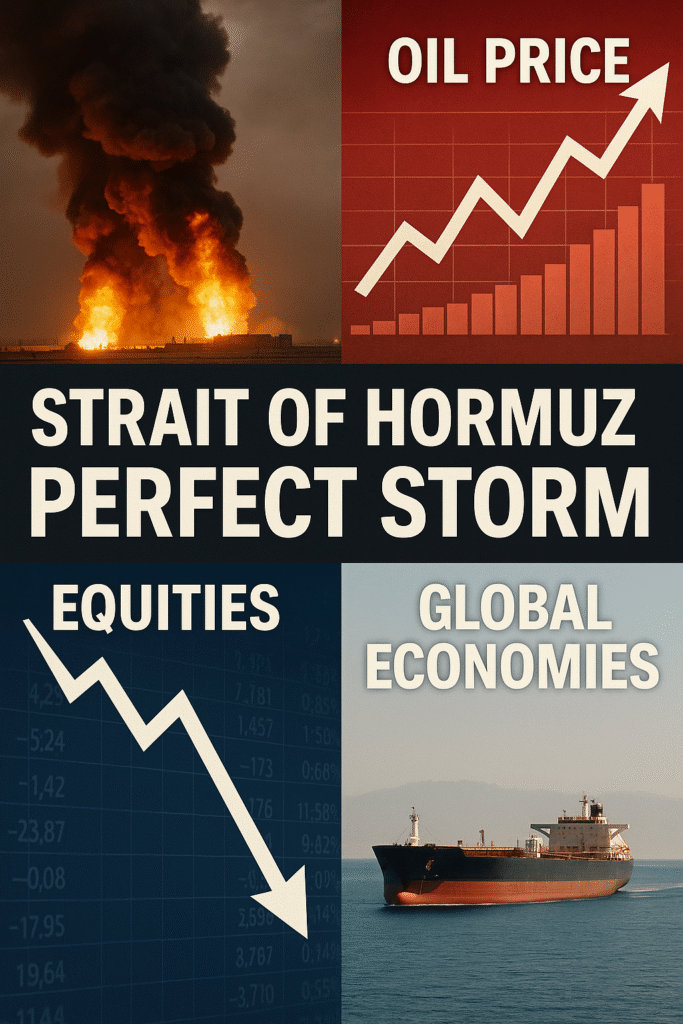

🌍 Iran Retaliates: Could Oil Surge 70% & Shock the Global Economy?

June 23, 2025 – Hypothetical Outlook

📊 Current Market Context

Before any retaliation, oil prices were already volatile—Brent crude hovered around $77–$78, with futures flat as traders weighed geopolitical risk and the Dow gained approximately 200 points despite recent U.S.–Iran aerial strikes.

⚠️ Escalation Scenario: Iran Retaliates

If Iran threatens or disrupts the Strait of Hormuz—through mine-laying, drone strikes, or shipping interference—oil markets could experience:

- Potential spike of up to +70% in Brent crude, reaching $130–$150/barrel in a sustained disruption.

- Inflation surge: Energy-driven price hikes could force central banks to maintain or even raise interest rates.

- Equity market turbulence: A rush to safe havens like the dollar, gold, and U.S. Treasuries may ensue amid equity selloffs.

🌐 Macro Economic Fallout

- Global trade slowdown: Rising shipping costs and uncertainty could pressure global supply chains.

- Growth downgrade: A prolonged oil shock could drag global GDP by up to 1%.

- Emerging market strain: Oil-importing nations like India, Japan, and EU countries may face currency pressure and inflation challenges.

📉 Sector & Regional Impacts

- Energy stocks boom: Oil majors and geopolitically exposed energy firms would likely rally.

- Consumer squeeze: Higher fueling costs could depress discretionary spending and retail sales.

- Policy shift: Central banks, including the Fed and ECB, may delay rate cuts—or consider hikes—in response to inflation.

⚖️ Scenario Breakdown: Best-Case vs. Worst-Case

Best-case (limited harassment): Brief oil spike (~10–20%), minor dip in equities, quick recovery.

Worst-case (Strait closed >1 month): Massive oil surge to $130–150, sustained inflation, global slowdown, and possible bear market.

🧭 Investor & Policy Response

- Hedge positions: Investors may shift toward energy ETFs and stocks, while reducing equity exposure.

- Safe-haven inflows: Increased demand for the U.S. dollar, gold, and government bonds.

- Strategic intervention: Governments could release oil reserves, pursue diplomatic solutions, or secure shipping lanes.